The impact of Covid-19 on the luxury market in France

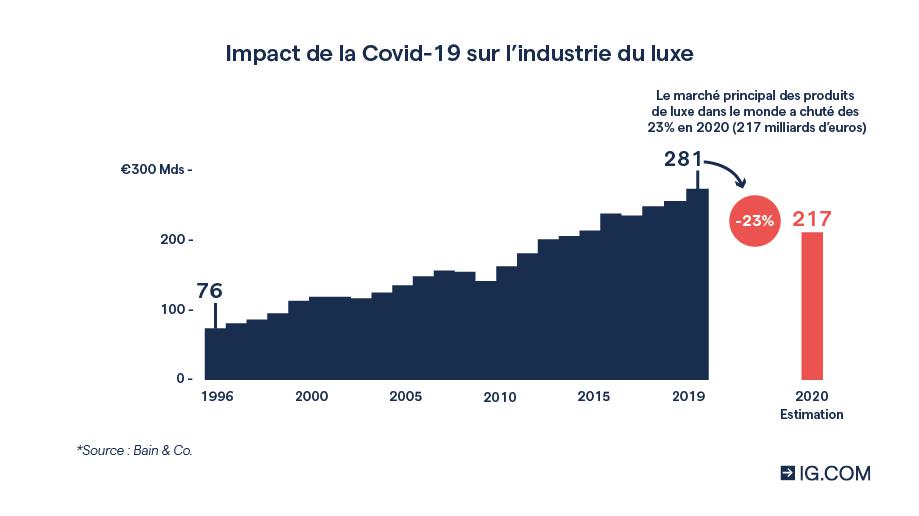

With sales down significantly in 2020, the global luxury goods market has fallen nearly 25% since January, stabilizing at 217 billion euros, a level not seen since 2009.

Although the effects of this crisis are already fading, the luxury industry is called upon to reinvent itself to return to growth. Let's analyze the impact of the health crisis on the luxury sector by answering questions such as: when and how will the luxury market recover? What are the emerging trends?

Traditionally, the luxury market is divided into two types of categories:

How has the health crisis impacted the luxury sector in France?

French luxury brands like LVMH, L'Oreal, Kering and Hermes, which are all in the top 11 of the world's largest luxury companies, have been forced to pivot to meet urgent public health needs and provide financial support for their employees. LVMH and Hermès, for example, have reallocated their production tool to produce hydroalcoholic gels, while Kering, Chanel or Louis Vuitton have launched into the manufacture of masks and over-blouses.

Like Hermès, there are French luxury companies which have proposed measures such as the reduction of the dividend paid to shareholders, the elimination of increases in the remuneration of managers, cash donations to hospitals and other organizations non-profit, or even a reduction in the remuneration of leaders (like Bernard Arnault of LVMH who gave up two months' salary) to deal with the health crisis.

While it is too early to quantify the financial toll of Covid-19 on the luxury industry in France, we can nevertheless say that this global health crisis has shaken certain fundamental aspects of the luxury industry, leading to changes that could be permanent.

Covid-19 and the luxury sector: the figures to know

Before the global health crisis, all luxury market indicators were green:

In 2019, the growth of the “experiential” luxury market was driven by sales of luxury cruises (+9%), luxury cars (+7%) and gourmet products (+6%) generating 1,300 billion euros, i.e. growth of 4% compared to 2018.

In the "personal" luxury goods sector, footwear and jewelery showed a growth rate of 9%, leather goods 7%, cosmetics 3%, the clothing sector 1%, while the watch sector was down 2%. The total revenue generated by the top 100 international luxury players in 2019 was $247 billion compared to $217 billion in 2018.